The Procrastinator's Guide to Doing Your Taxes at the Last Minute

Image: Bigstock

You have just a few days before taxes are due. April 15 is bearing down. And, for reasons that honestly don't matter anymore, you've waited until the very last possible minute to file.

Is it ideal? Absolutely not.

Is it survivable? Almost always.

How do I know? Because I am a (mostly) reformed procrastinator. And while I try really hard not to leave things until the 11th hour anymore, I have plenty of experience with last-minute tax scrambles.

Here's what I've learned: The final days before Tax Day are not a total loss. They're just... bumpy. Often filled with frantic document digging, weird math-induced emotions, and a few moments where you genuinely question whether anyone would notice if you just started making up a few numbers.

But I'm here to tell you... you can still do this (without making up any numbers).

Even if you haven't opened your tax software yet.

Even if your "filing system" is a shoebox you keep meaning to sort.

Even if you're currently Googling "can I be arrested for filing my taxes late?"

Breathe, dear reader.

This is your step-by-step guide to filing quickly, accurately, and without any unnecessary stress or penalties. I'll walk you through what's mandatory (your income), what's optional (your deductions), what to do if you're completely out of time, and how to avoid the most common last-minute mistakes.

Let's get started.

Step 1: Skip the Stress — Let Software Do the Heavy Lifting

No matter what situation you're in, if you're filing at the last minute, using tax software is your best move.

It's faster, easier, and far less error-prone than trying to fill out the forms yourself. (That's not just me saying that; the IRS is on record saying it, as well.) And if you're filing an extension instead of a full return? Tax software can handle that too.

Here's why tax software matters right now:

- It helps you avoid mistakes. The software checks your math, prompts you for missing info, and flags problems before you file.

- It walks you through step-by-step. Don't waste time guessing or researching which forms you need or what box to fill in.

- It auto-imports info when possible. Many programs can pull in data directly from employers or financial institutions.

- It files electronically. The IRS processes e-filed returns faster than paper ones — and you'll get a confirmation that your return was received.

- It lets you file an extension if you run out of time — and you can usually do it right inside the program, no separate paperwork required.

Some tax software will even estimate how long it'll take you to finish your return before you begin. That's a small thing, but when you're feeling overwhelmed, it helps to know that you're 47 minutes from done — not seven hours away.

So before you do anything else — before you start digging through envelopes or texting your ex-employer for a W-2 — pick your software and open it up.

Now that you've got a system in place, let's figure out just how urgent your situation really is.

Step 2: You Can Still Beat the Clock! Use This Table to Find the Best Strategy

Before we jump into the full checklist, let's do a quick triage.

Depending on what time it is, what you've gathered so far, and how much of your financial life is still stuffed into unopened envelopes, your strategy might need to shift.

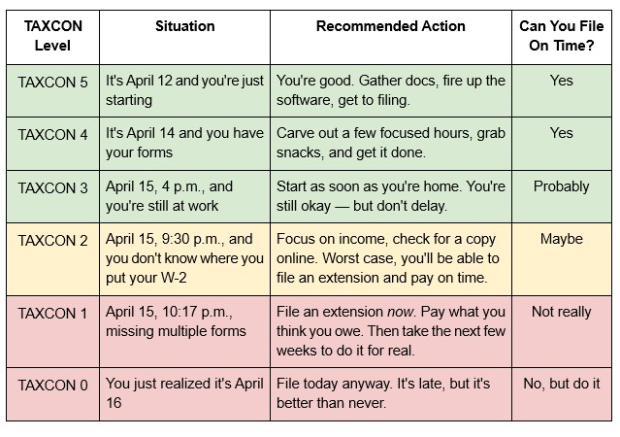

This is where the TAXCON scale comes in — like DEFCON, but for your taxes.

Image Source: Zacks Investment Research

Here's why it's still worth filing something, even if you can't pay everything today...

The IRS charges a failure-to-pay penalty of 0.5% per month on your unpaid taxes.

But the failure-to-file penalty is 5% per month. That's 10 times worse.

Let's say you owe $20,000 and don't file or pay by April 15:

- If you file on time but can't pay, the penalty is $100 per month.

- If you don't file at all, it jumps to $1,000 per month — plus interest.

Penalties can keep growing until they hit 25% of your total tax bill. And interest is charged on top of that — currently at an annual rate of 7%.

Bottom line: If you do nothing, the cost adds up fast. But if you file — even just an extension — and pay what you can, you'll avoid the worst of it.

Even if you can't pull everything together in time, filing an extension and paying what you reasonably think you owe can help you avoid the worst penalties. If you're cutting it close and unsure whether you'll make the deadline, I recommend going ahead and filing an extension as a backup. Again, the penalty for failing to file on time is much worse than not paying on time. Then you're at least covered if you accidentally blow past the deadline.

The TAXCON chart can help you make the best use of your time so you can avoid potential penalties. If you're TAXCON 5 to 2, keep going to the next section — you've got time to get your income filed and maybe more. If you're TAXCON 1 or 0, skip ahead to Step 6: Filing an Extension.

Step 3: Report Your Income First — It's the Only Thing You Have to Get Right

If you're scrambling to file, the most important thing you can do — and the part you absolutely cannot skip — is reporting your income.

Why? Because the IRS doesn't care if you forget to include a deduction for donating your old couch. They do care if you under report your income. That's what penalties are based on. That's what triggers letters.

So if you're short on time or overwhelmed, this is the piece you must get right.

Start by gathering your income documents. Here's what to look for:

- If you were a salaried employee — W2

- For freelance, contract, or gig work — 1099-NEC

- For income through platforms like PayPal, Venmo, or Etsy (thresholds changed in recent years, so check your account even if you didn't earn a lot) — 1099-K

- For interest earned on savings or high-yield savings accounts — 1099-INT

- For dividend income from investments — 1099-DIV

- For capital gains or investment sales — 1099-B

- For retirement account distributions — 1099-R

- If you have income from partnerships, S corps, or trusts — Schedule K-1

Not sure if you're missing something? You can view your IRS Wage and Income Transcript online, which shows every income form the IRS has received for you. Go to irs.gov/individuals/get-transcript and follow the steps to view it securely.

If you know you've received a form but don't remember where you put it, you can check for a downloadable copy online.

- W-2 or 1099 from a job: Log into your payroll system (like ADP or Gusto) or call HR if it's during business hours.

- Interest, dividends, distributions, or capital gains: Log into your bank or investment account and look under "Tax Documents."

No luck? Don't guess. If it's income, and you can't verify it, it's safer to file an extension. (Details on this in Step 5 below.)

Once your income is entered, the hard part is done. Even if you can't finish everything else on time, you now have the information you need to pay what you owe — and that's the most important thing for avoiding penalties. (You can always file an amended return after Tax Day with your credits and deductions.)

But if you still have time and energy, your next step is to work on lowering what you owe with deductions and credits.

Step 4: Want to Owe Less? Here's How to Lower Your Tax Bill Fast

If you've entered your income and know roughly what you owe and still have time before the deadline, you should look at ways to reduce your tax bill. This is where deductions and credits come in. This step is theoretically optional — but very valuable.

Deductions reduce your taxable income (meaning you're taxed on a smaller number). Credits reduce your tax bill directly (dollar-for-dollar).

Start with above-the-line deductions. These will help lower your tax bill regardless of whether you take the standard deduction or you end up itemizing. The most common above-the-line deductions are...

- Retirement accounts like a traditional IRA, 401(k), 43(b), 457 plans, as well as a few less common retirement accounts

- Health Savings Accounts (HSA) and Archer Medical Savings Accounts (MSA)

- Student loan interest

- Tuition and certain other educational expenses for certain qualified institutions

- Most business expenses related to the operation of a sole proprietorship

- Alimony from divorces before 2019 (under certain terms)

- Early withdrawal penalties from a CD or savings bond

- Qualified educator expenses for people who teach grades K-12 who work at least 900 hours during the year

- Certain military moving expenses

From there, you have to pick between itemizing or taking the standard deduction. If you're short on time, the easiest option is to take the standard deduction. For your 2024 return, that's:

- $14,600 for single filers

- $29,200 for married filing jointly

- $21,900 for heads of household

For the vast majority of taxpayers, the standard deduction will lower your taxes the most. You're only better off itemizing if your total deductible expenses are higher than the standard deduction; usually that means having...

- High mortgage interest payments

- Large out-of-pocket medical expenses (more than 7.5% of your income)

- Substantial charitable donations

- Major losses from a federally declared disaster

Not sure? Let your tax software do the math.It will calculate both and pick the one that gives you the lowest tax bill.

If you want to claim any deductions or credits, you'll need to round up some more forms. Here are some of the most common:

- For mortgage interest or student loan interest — Form 1098

- For charitable donations, expenses, etc. — receipts or documentation

- For education credits (from a college or university) — Form 1098-T

- Claiming expenses paid to a person or business — EINs (or SSN) for those people/businesses

Missing something like an EIN or a 1098-T? Call the provider right away. Many have this info ready to go during tax week — they know we're all calling last-minute.

If you don't have the paperwork on hand and aren't sure you'll get it before the deadline, you have two options that will help you avoid penalties:

1) File using the standard deduction now and amend your return later if you uncover deductions or credits you missed.

2) File an extension, then finish your full return once you have everything.

...which brings us to our next step...

Step 5: Almost Out of Time? File an Extension and Avoid the Worst Penalties

If you're running out of hours and still don't have what you need — or you already know you're just not going to finish everything in time — file an extension.

It's fast, it's easy, and it gives you until October 15 to finish your return.

PLEASE NOTE: An extension gives you more time to file — not more time to pay. I cannot emphasize this enough; when you file an extension, you still have to pay an estimate of what you owe by the deadline on April 15. If you can't pay it all at once, you can set up a payment plan online with the IRS.

If you owe taxes and don't pay by the April 15 deadline, the IRS will start charging interest and possibly a penalty on the unpaid amount — even if you file the return itself within the extension window.

Here's how to do it the right way:

First, file Form 4868 to request your extension. Most tax software can do this for you with just a few clicks. Or, use the IRS Free File Fillable Forms tool at irs.gov/freefile. You must submit this request by April 15 at 11:59 p.m. local time.

Next, estimate and pay what you owe. If you've already entered your income into your tax software, you'll have a pretty good idea of what your tax bill looks like. You can also use the IRS Tax Withholding Estimator to get a ballpark figure.

No time to estimate? You're still covered, as long as you pay enough to qualify for the "safe harbor" rule. The IRS will not charge you an underpayment penalty if you...

- pay at least 90% of the tax you owe this year, or...

- pay 100% of the tax you owed last year (110% if your AGI was over $150,000 that year).

So if you're really down to the wire, you can simply pull up last year's taxes and make sure you've paid 100% (110% for AGI over $150,000) of the total tax you owed last year.

If you hit either of those marks, you're protected from failure-to-pay penalties — even if you file your full return a few months later. And if you ultimately find enough credits and deductions to lower the amount owed, you'll simply get the amount you overpaid back as a refund.

Important: Even if you can't pay the full amount now, file the extension and pay something. The failure-to-file penalty is 10x worse than the failure-to-pay penalty.

Once the extension is in and your payment is made, your most urgent task is done. You've avoided the biggest risks — and bought yourself some breathing room.

Step 6: The Final Checks That Can Save You from IRS Headaches

Whether you're filing your full return or just requesting an extension, here are the key things to double-check before you click submit or head to the post office.

These small details trip people up all the time — and can lead to delays, penalties, or even rejected returns.

E-filing? You have until 11:59 p.m. local time on April 15 to submit your return or extension electronically. If it goes through before midnight, you're good.

Mailing your return or extension? It must be postmarked by April 15. Don't drop it in a random mailbox and hope for the best — use a staffed post office and ask for a receipt or use certified mail.

Can't find your IP PIN (if you have one)? This doesn't apply to everyone. However, if the IRS has issued you an Identity Protection PIN in the past, you must include it when filing. If you leave it out, your return will be rejected. You can retrieve it at irs.gov/getanippin.

Quick Review Checklist: Finally,the IRS strongly suggests going back through and double checking all of your work before you file, but that can be a problem if you're short on time. Even if you only have five minutes, it's more than enough time to check these six details you absolutely can't get wrong.

- Bank account info is correct and up to date. Refunds go where you tell them — don't accidentally send yours to someone else's account (or to a closed account).

- All Social Security numbers are correct. This includes yours, your spouse's, and any dependents.

- Your return is signed. If you're filing jointly, both spouses must sign — even when e-filing.

- Your address is correct. The IRS still sends important mail the old-fashioned way.

- You didn't forget about income. Even that $18.94 interest form from your bank matters — the IRS sees it, too.

- If you filed an extension, you paid something. Even a partial payment helps reduce penalties and shows good faith.

This last-minute review might only take a few minutes, but it can save you hours (or weeks) of dealing with errors later.

Step 7: You Filed. You're Fine. Here's What to Do Next

Once you've checked all the boxes, reviewed your numbers, and hit submit — that's it. You're done. You've filed your taxes (or filed for more time and paid what you could).

Was it messy? Maybe.

Was it stressful?Probably.

But you got through it — and that's what counts.

Save a copy of your return or extension confirmation for your records (digital is fine, but make it easy to find later). If you filed an extension, mark your calendar: October 15, 2025 is your new deadline.

Then, close your laptop. Collect your papers in a neat stack. Take a deep breath. Go eat something. Watch something mindless. Remind yourself that you pulled it off — and that's what matters.

If you're feeling overwhelmed, behind, or just a little embarrassed that you waited this long — you're not alone. Millions of perfectly wonderful people (present company included) have filed their taxes at the last possible minute.

Whatever your reason, it doesn't really matter. What matters is that you're here, getting it done.